The novel coronavirus (COVID-19) has had a profound and unprecedented impact on the world since the pandemic started to spread from China at the end of 2019. As the deadly virus crossed borders and started to take lives, governments the world over have taken extensive measures to try and mitigate its spread, imploring and later forcing populations to stay at home and exercise social distancing. In parallel, many businesses and companies have shuttered their doors including shopping malls and stores selling non-essential items.

The COVID-19 public health emergency has had a significant impact on the global economy in general and on retail in particular; some of its effects will only be realised once the pandemic has passed. However, it is already clear that the Coronavirus has a significant impact on consumer behaviour. People are more cautious about going to public places and often prefer to shop online, avoiding the risk of crowds and the inconvenience of long queues. Together with the forced lockdowns and the general recommendation to stay at home, this is changing the way consumers shop with many of them turning to online shopping. Many consumers worldwide are likely to continue purchasing online, expanding their online shopping into categories they would have previously only bought instore.

The dramatic increase in the number of online shoppers worldwide during the current pandemic marks an acceleration of the shift in consumer behaviour towards the “online first” model. Even with government enforced lockdowns being lifted around the world and brick and mortar stores beginning to reopen, many shoppers are choosing to continue to shop online rather than returning to the high street, suggesting that the recovery of the high street retail will be slower and might never get back to pre COVID-19 levels.

The acceleration of the shift to online shopping versus brick and mortar will force many retail businesses to rethink and adapt their future business models and multichannel strategies.

Ecommerce increases during COVID-19

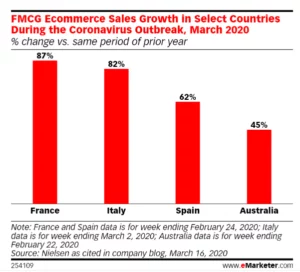

With government enforced lockdowns across the globe, many have turned to shopping online as the only viable way to purchase items that they need. Non-discretionary buying jumped in the first weeks of the COVID-19 outbreak, followed by a jump of discretionary ecommerce (excluding travel). Discretionary ecommerce sales are picking up speed in markets showing signs of control over the pandemic, as many shoppers gain financial confidence again, while still avoiding visiting physical shops even after their reopening.

A report from Kantar, conducted in March this year shows that in France, Germany and the UK, Europe’s three largest ecommerce markets, the share of consumers that make 50% or more of their total number of purchases online has increased dramatically. The same study also revealed that 60% of consumers will continue to buy as much online as they do now even after the pandemic has passed. Though the majority of consumers stated that they are focusing their spending on essential goods, 80% said that they will return to purchase non-essentials online in 2020, with 50-60% stating they plan to buy clothing and home electronics during the year.

Nilsen’s survey, that was conducted in March across 11 markets in Asia, has found that for most non-FMCG products, the rise in online shopping during the COVID-19 outbreak is likely to continue, with many shoppers planning to keep buying clothing, cosmetics and electronics on online platforms even after the pandemic is over. According to a later research conducted by the research institute Capgemini in April 2020, consumers worldwide plan to continue low interaction with physical stores post-pandemic and plan on increasing their levels of interaction with online retail channels in the next 6–9 months.

This highlights an opportunity for ecommerce merchants, as consumers form new shopping habits as a result of the pandemic. For brands and retailers of discretionary items, who trade online across multiple regions (Asia, USA, Europe) the negative effect of COVID-19 on their online sales was moderate to none, with some of these brands seeing an overall increase in their online sales. With the exception of specific supply chain issues and a short-term drop in demand at the midst of the COVID-19 outbreak, we have seen an overall positive trend in online demand across all markets, balancing between markets that are slightly affected, deeply affected and those that are seeing a light at the end of the tunnel where demand is picking back up.

Cross-Border Ecommerce continues during COVID-19

Looking at YTD mid-April 2020 we have seen an average increase of 11% across all markets worldwide compared to the same period last year. However, diving into separate geographies and regions we can see significant differences between regions that have not been severely affected versus regions with severe implications i.e. high infection rates and therefore extreme quarantine measures taken. In this period of time we have also seen significant differences in market performance between regions depending on what phase of the pandemic they are in – from initial cases to full outbreak, and measures taken by authorities to overcome the peak, to the period where the outbreak appears ‘under control’ and lockdowns are loosened.

Although many standard carriers are unable to deliver packages to certain regions or are incurring massive delays due to lack of commercial flights that they use for transport, many others have managed to secure capacity with airlines converting commercial flights for cargo. Meanwhile express carriers are maintaining operations as usual, using their own fleet of planes. For retailers in highly affected regions, we have witnessed occasional disruption to their distribution centre operations due to temporary shutdowns, but those have been few and usually limited to a 2-3 week period.

Our analysis of the import ecommerce trend at a country level, based on the data of over 350 merchants selling internationally into different markets, reveals similar trends in many regions since the initial COVID-19 outbreak.

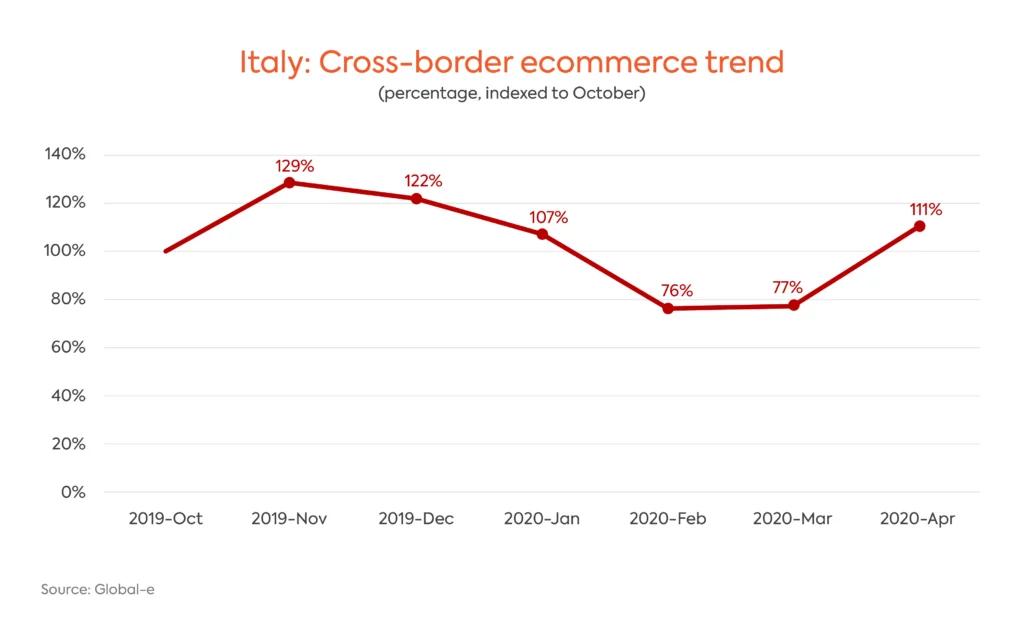

Italy:

The first cases of COVID-19 were discovered at the end of January, with the daily infection rates starting to spiral upwards in the second part of February, hitting record levels in March. However, from early April with daily numbers of infections dropping 30-40% and tensions being somewhat relaxed, we can see that discretionary online cross-border spending in Italy has jumped back up since the beginning of April, with sales increasing by over 40% from March, exceeding the pre-crisis figures.

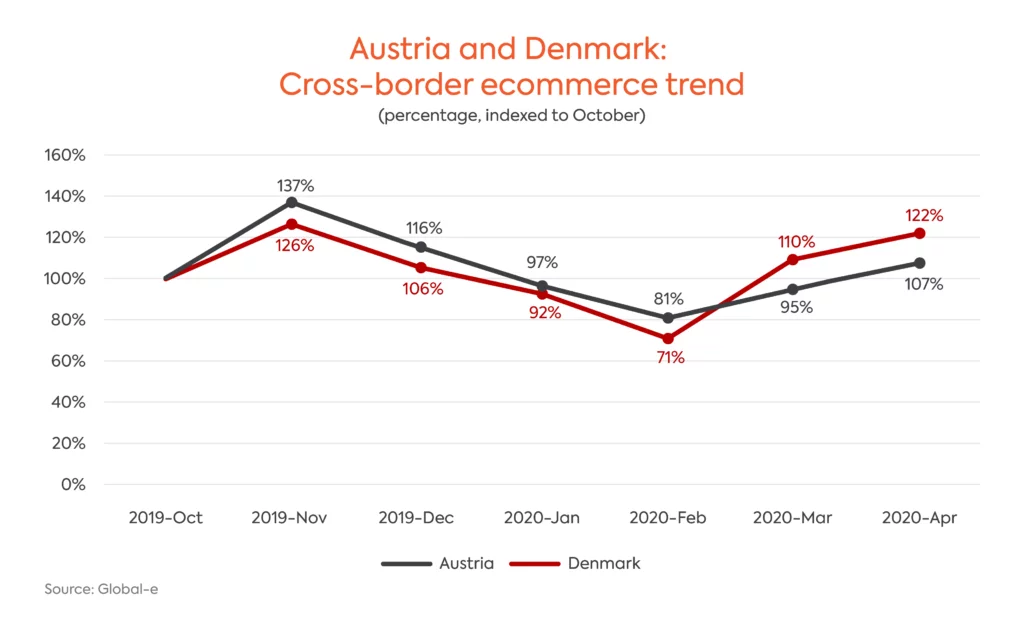

Austria and Denmark:

In these markets, where government actions in response to COVID-19 has significantly controlled infection rates and where a gradual ‘back to new normal’ has been implemented as of April, we have seen discretionary online cross-border spending growing considerably as customer confidence increases.

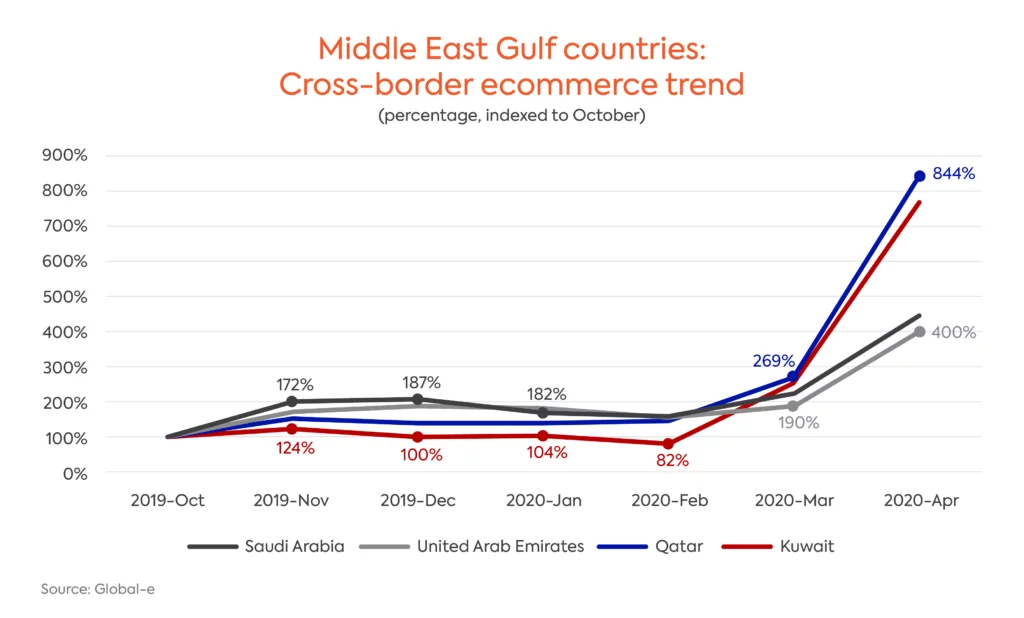

Middle East (Gulf countries)

The Gulf countries have taken harsh measures with strict lockdowns and a large scale disinfection operation in public places in order to avoid a vast outbreak of COVID-19. However, the lockdowns haven’t seemed to weaken discretionary online cross-border imports with April sales making a quantum leap gearing up to Ramadan holiday gifting, and the rest of the period trading relatively at a pre-crisis level.

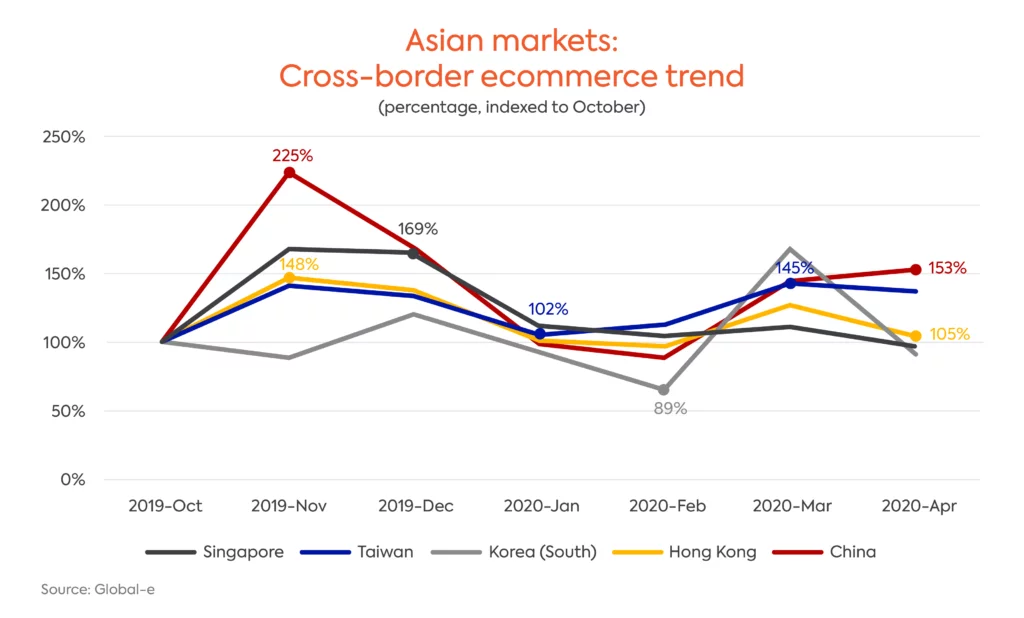

East Asia markets:

The East Asian markets that were the first hit by COVID-19, saw decreases in sales in January and February as the markets experienced increasing numbers of infections and casualties, with widespread lockdowns in response. As these markets overcame the worst, so did their sales, with March seeing a rebound to the same share of sales as December 2019, just before the pandemic hit.

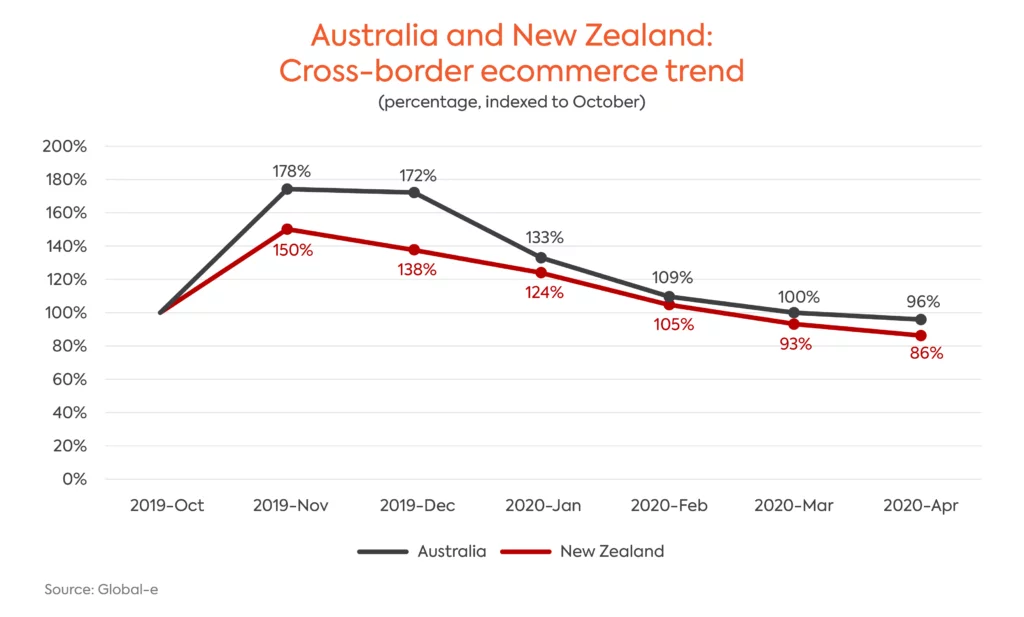

Australia and New Zealand:

These markets entered relatively late into the eye of the COVID-19 storm and went into lockdowns mid-end March. This has pushed cross-border ecommerce imports to low trade levels in both March and April, after a strong trading period in the first half of Q1 2020.

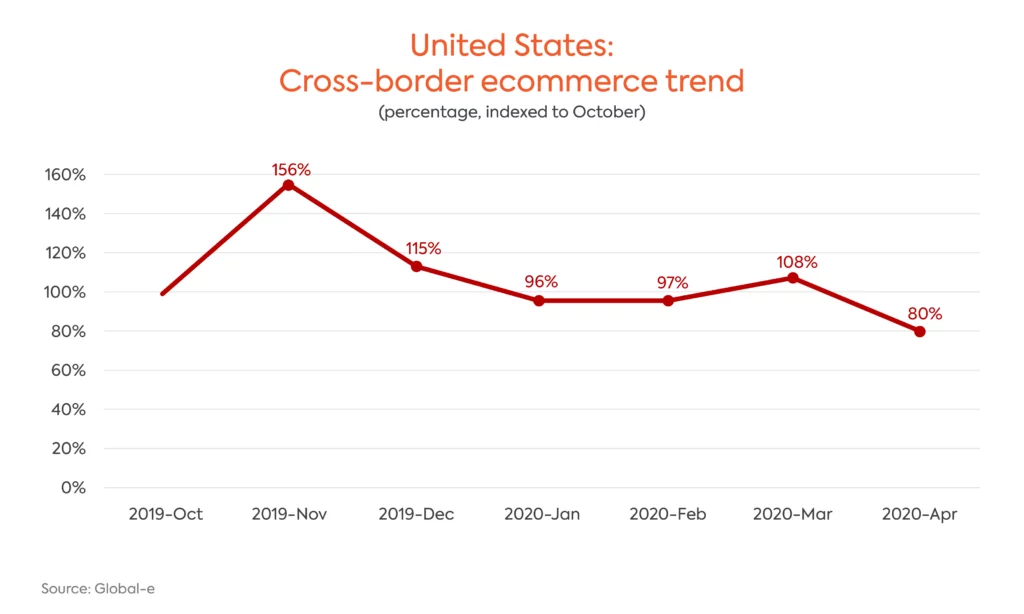

The USA:

The USA entered into COVID-19 control lockdown in key states comparatively late (during March) and has experienced numbers of infections growing daily throughout April, with over one million people reported as infected with coronavirus. Accordingly, as of the end of April, we are still seeing a downturn in cross-border online sales as seen during February and March in the affected European markets. As the current stage in the USA is still within the peak of the outbreak, with many states still facing daily infection numbers growing, we are seeing a slowdown of discretionary cross-border imports, with April trading 25% below March figures. Based on the performance of other markets in the world where the outbreak of COVID-19 has reached a more controllable level, we expect to see a rapid rebound once the situation is more stable.

Diversification through Cross-Border Ecommerce

COVID-19 has spread dramatically, affecting virtually all countries worldwide. At the end of April 2020, while some areas of the world are already seeing their way to recovery, others are still in the eye of the storm.

We have seen throughout the crisis up to this point, that consumer behavior related to discretionary cross-border ecommerce imports differs depending on the stage of the pandemic in each market. As the spread of COVID-19 differs between markets, reaching its peak at different periods during the first third of 2020, we have seen that brands and retailers selling across multiple markets were able to balance the sales between markets and in many cases have seen increases in their overall international ecommerce sales throughout the crisis.

The lockdown and social distancing guidelines are encouraging additional populations to purchase online whilst strengthening ecommerce as the preferred shopping channel, even in markets where stores are re-opening. This, we believe, will accelerate the online shopping trend, that has already seen rapid growth during the last decade, continuing after the pandemic.

The differences in performance from market to market highlights the importance of diversification, suggesting a new international online strategy. Selling online to markets worldwide enables merchants to spread their risk rather than focusing only on their domestic market or a limited number of key international markets.

For global brands COVID-19 will be strengthening the move to a D2C model based on online presence, in order to counter the long-term decline in high street footfall and to maintain brand identity and values in the shift to ecommerce retail.

Key tools for optimising cross-border ecommerce sales during challenging times:

Simplifying the shopper journey for international customers by offering them a seamless shopping experience that is tailored to their market and adjusted to local shopping preferences is critical for merchants looking to capitalise on the cross-border ecommerce opportunity. With the global increase in online shopping, providing shoppers with a localised experience, similar to their domestic online shopping experience, is more important than ever. This means enabling shoppers to view prices and pay in their local currency, accepting payments via local and alternative payment methods, providing them with taxes and duties calculations and prepayment options and offering a wide range of attractively-priced shipping and return options.

Specific points to address during the COVID-19 pandemic:

- Update relevant messaging for destination markets

Communicating to shoppers around the world that your online shop is open for business to their territory (if not – this should be stated clearly as well). Clear and localised communication on your webstore should be in conjunction with a streamlined and localised international customer experience,

- Offer special promotions

Offering special promotions and discounts is always an efficient way for merchants to convert traffic into sales and improve conversion rates. The last few months have been no exceptions, with Global-e’s retail partners who have launched spring discounts and other promotions experiencing a high increase in numbers of orders.

- Deploy a multi-carrier approach to international logistics

Border closures and lockdowns in many countries have resulted in a drastic reduction in international travel, causing a huge drop in the availability of international flights for cargo which has created delivery delays to some markets. A multiple carrier approach which includes many shipping carriers that operate their own fleet such as DHL, means that merchants can minimise these delays and reduce the impact on their cross-border ecommerce logistics and improve the service for customers.

- Keep international clients informed

Communicating clearly to international shoppers that deliveries may be subject to delays and making sure to provide them with tools to track their shipment whenever possible is crucial in order to manage expectations and provide a high-quality service, even during these challenging times. Providing international shoppers with simple return options is important, whilst adjusting your returns policy to allow shoppers more time to send back their purchase is advised.